Featured

Table of Contents

While new credit scores can aid you restore, it is essential to space out your applications. If you have a household member or good friend with stellar credit history, consider asking to include you as a licensed user on one of their charge card. If they do it, the full background of the account will certainly be contributed to your credit report reports.

Before you take into consideration debt settlement or personal bankruptcy, it's crucial to recognize the potential benefits and disadvantages and how they could apply to your circumstance. Both options can lower or remove huge portions of unprotected financial obligation, aiding you prevent years of unrestrainable repayments.

If you're uncertain that financial debt negotiation or insolvency is appropriate for you, below are a few other debt relief alternatives to think about. The proper way will certainly depend upon your situation and goals. If you have some adaptability with your budget plan, right here are some increased financial obligation payment options you can go after: Begin by noting your financial debts from the smallest to the largest equilibrium.

Building Your Custom Path to Freedom for Dummies

The counselor negotiates with lenders to lower rates of interest, waive late charges, and develop a convenient monthly repayment. You make one combined settlement to the company, which then pays your banks. While a DMP does not lower the principal balance, it aids you settle debt much faster and a lot more affordably, generally within 3 to five years.

While you can work out with creditors by yourself, it's often a complex and time-consuming process, specifically if you require to fix a huge amount of financial debt throughout several accounts. The procedure requires a strong understanding of your funds and the financial institution's terms in addition to confidence and determination. For this factor, there are financial debt relief companies likewise referred to as financial obligation negotiation firms that can take care of the negotiations for you.

People who enroll in the red relief programs have, usually, approximately $28,000 of unprotected financial obligation across almost 7 accounts, according to an analysis appointed by the American Association for Financial Debt Resolution, which considered customers of 10 significant financial debt alleviation firms in between 2011 and 2020. Regarding three-quarters of those clients had at least one financial obligation account efficiently settled, with the normal enrollee resolving 3.8 accounts and even more than fifty percent of their registered financial debt.

It's common for your credit history to fall when you initially begin the financial obligation alleviation process, particularly if you quit making settlements to your lenders. As each financial obligation is resolved, your debt rating should start to rebound. Make certain you recognize the overall costs and the result on your debt when evaluating if debt negotiation is the appropriate selection.

Rumored Buzz on Knowing Fees for Credit Counseling Services : APFSC Help for Debt Management

As stated over, there are options to financial obligation settlement that may be a better suitable for your monetary scenario. Below's a quick breakdown of just how each choice functions: Financial obligation debt consolidation allows you combine multiple debts into one by obtaining a new funding to pay off your present financial debts. This method transforms numerous financial debts right into a single regular monthly payment and commonly provides a reduced passion price, streamlining your funds and potentially saving you cash in time.

Below's just how every one jobs: Financial debt combination car loans: These are individual lendings that you can make use of to resolve your existing debts, leaving you with simply one regular monthly expense, normally at a reduced rate of interest price. Balance transfer credit score cards: This includes moving your existing bank card balances to a new credit history card that uses a lower rate of interest or an advertising 0% APR for a collection period.

When the period ends, interest prices will certainly be considerably high typically over 20%. Home equity financings or HELOCs (home equity lines of credit score): These finances allow you to obtain versus the equity in your home. You obtain a round figure or a credit line that can be used to pay off debts, and you normally gain from reduced rates of interest compared to unsecured financings.

Examine This Report on This Organization Approach to Secure Financial Relief

These strategies have numerous benefits, such as simplifying your payments by settling numerous into one and potentially decreasing your rate of interest. They usually come with a setup fee ranging from $30 to $50, and a month-to-month maintenance fee of around $20 to $75, depending on the agency you work with.

Having a great deal of debt can be frustrating, however it's still critical to take the time to think about the details of different remedies so you recognize any kind of potential risks. The very best debt prepare for you depends on your monetary scenario. If you're having problem with your bills but still have not missed out on any kind of repayments, a debt monitoring plan may be an excellent fit particularly if you do not desire your credit history to tank.

Whichever your situation is, think about speaking to a qualified debt therapist, a bankruptcy lawyer, or a certified financial obligation expert before progressing. They can assist you obtain a full understanding of your finances and choices so you're better prepared to choose. One more factor that affects your choices is the kind of financial debt you have.

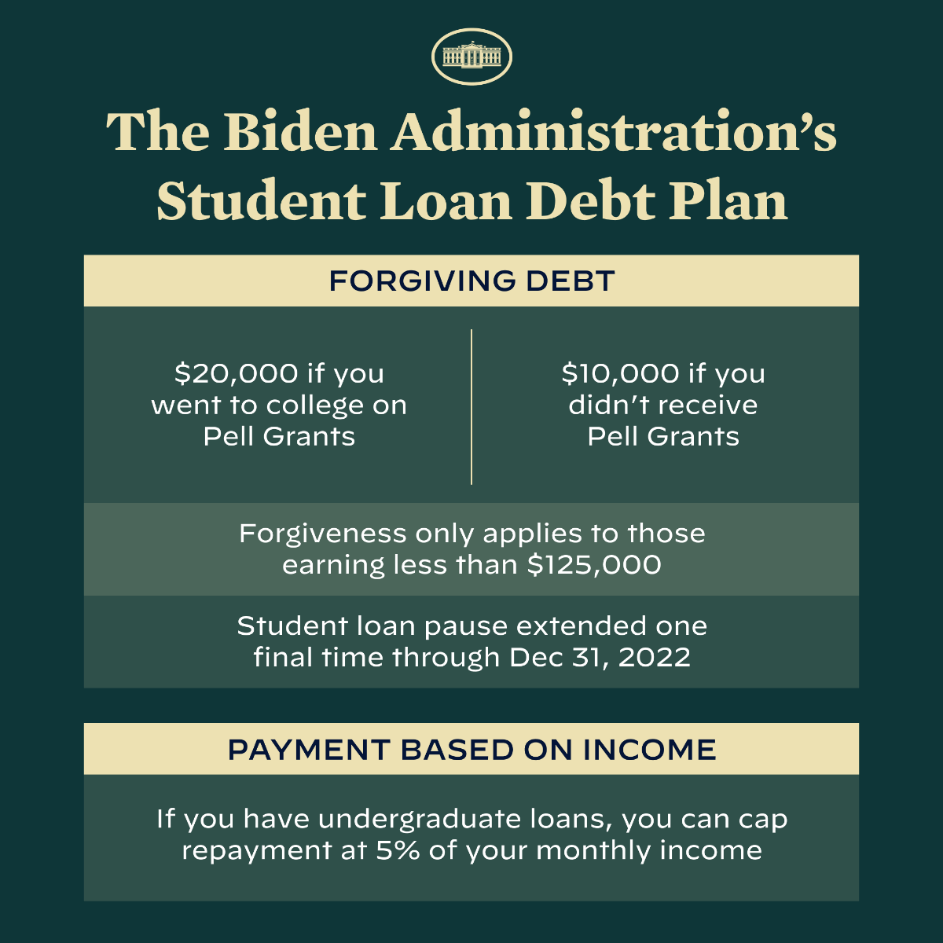

It is important to comprehend that a discharge stands out from financial obligation mercy, and financial debt does not obtain "forgiven" with an insolvency filing. Our West Hand Beach bankruptcy legal representatives can clarify in even more information. Generally, "debt mercy" describes a situation in which a financial institution does not think it can gather the total of the financial debt owed from a debtor, and either quits trying to accumulate or concurs to forgive a quantity much less than what the borrower owed as component of a debt negotiation agreement.

Not known Details About Private Relief Options Reviewed

When this happens, the financial obligation will certainly be taken into consideration "terminated" by the internal revenue service, and the borrower will typically get a cancellation of financial obligation create the amount of debt forgiven is taxed. In a personal bankruptcy case, debt is not forgiven by a financial institution. Instead, it is discharged by the bankruptcy court, and discharge has a various significance from debt mercy.

Table of Contents

Latest Posts

The Basic Principles Of Restoring Your Financial Standing After Debt Forgiveness

The Buzz on The Pros to Consider When Considering Debt Forgiveness

Some Known Factual Statements About True Stories from Individuals Who Found Peace of Mind

More

Latest Posts

The Basic Principles Of Restoring Your Financial Standing After Debt Forgiveness

The Buzz on The Pros to Consider When Considering Debt Forgiveness

Some Known Factual Statements About True Stories from Individuals Who Found Peace of Mind